Being an Amazon Seller in 2021; Year in Review

I’m the founder and CEO of Viahart (est. 2010), an e-commerce focused educational toy company. We did $8.8 million in sales in 2021. This article is going to tell you what it was like to run this business in 2021 vs. 2020, amidst threats like the Amazon aggregators, supply chain difficulties, inflation, and even getting “dragged” on social media. You may want to read last year’s version of this article before reading this one.

Let me give you a bit of context to our business. We’re sellers on Amazon’s marketplace, Walmart.com, and eBay. We also sell our products to stores across the United States and sell internationally through distributors in Japan, Australia, Canada, the UK, and the EU. Our products are made under our supervision in China, Vietnam, and Indonesia. We operate our own warehouse in Texas and also use Amazon’s warehouse and fulfillment network to get our products to our customers. We make building toys, active play toys, and we are the largest direct-to-consumer e-commerce seller of swimming kickboards and plush animals in the USA.

Breakdown of Sales by Channel

The green sliver (0.5%) is direct-to-consumer sales on our websites

Amazon — 90.8% of Our Sales

Sometimes I ask people what they would do if they ran my company. The most common answer is “build your business off Amazon”. Amazon was 98.1% of our sales in 2018. We’ve now got it down to 90.8% in 2021. At the current trend, it’ll take us 17 years for Amazon to account for less than 50% of our business.

That’s a problem. You don’t want too many sales concentrated with a single customer because if they change their mind about you, your business can evaporate overnight. With Amazon at 90.8% of our sales, were we to lose them, we could not afford to pay our rent nor the wages of our employees. Further, without Amazon’s sales volume, we wouldn’t be able to demand quality from our suppliers, nor cheap container shipping. We would go bust, fast.

If we don’t order by the container load, factories won’t care enough about our business to make high quality products. Further, inexpensive international shipping requires container volumes.

Thankfully, selling on Amazon isn’t quite like selling to Walmart. There is no capricious buyer who can decide that he or she no longer likes you. We sell on a marketplace, so while it is possible for us to get kicked off, the risk isn’t quite the same. However, selling on a marketplace comes with other problems.

Problem #1: we live and die by our position in Amazon search. Like Google SEO, if Amazon changes their search algorithm in a way that puts our items onto page 2, our sales will fall tremendously. I’ll give you an example: our 500 piece Brain Flakes building toy is our best selling product on Amazon. In the fourth quarter of 2020, the search that led to the most sales was “building toys”, which was the 4,801st most searched term on Amazon in Q4 2020. 5% of those searches resulted in a purchase of Brain Flakes®. However, in Q4 2021, we no longer were in the top 3 of products purchased for “building toys” searches. This really hurt our sales and were it not for more people searching for our brand directly, our overall sales would have fallen.

Enabling the world’s next generation of engineers through confidence building and spatial learning (while giving mom and dad some peace and quiet) — Brain Flakes!

Problem #2: The “moat”, or competitive advantage, from having more, better reviews than your competitor is unreliable. Depending on Amazon’s policies of the day, the rate at which you accumulate reviews can be slow, then fast, then faster, then slow again. Meanwhile, at any time, Amazon can delete 1,000s of your hard-earned (or fraudulent) reviews with the push of a button. In other words, new entrants to the Amazon marketplace can quickly accumulate inflated reviews, making a long review history for a product on Amazon irrelevant to its long-term profit defensibility.

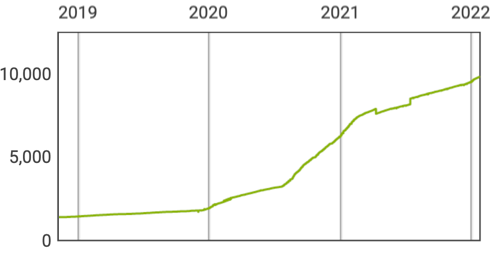

The number of reviews for Brain Flakes on Amazon. Look closely and you’ll see how volatile they are.

Problem #3: Amazon’s policies can have huge impacts on your profitability. Our warehouse is in Dallas, Texas. Amazon also has a warehouse in Dallas. The cost of replenishing our inventory from our warehouse to Amazon’s is $375 per truckload, but when Amazon decides to reroute those shipments to Charlotte, North Carolina the cost goes up to $2,700 per truckload. This happened to us and at 2 truckloads per week, the change was an annualized $240,000 per year (3% of our Amazon sales) cost increase.

The Viahart warehouse is at the red arrow. We were sending our shipments just West, until Amazon decided to route our stock replenishments East to faraway Charlotte.

Problem #4: Amazon can and will knock you off, they will appear ahead of you in search, and they will beat you on price. It’s an unwinnable battle. We have a few items that compete with products sold by Amazon. When Amazon has stock at their normal price, we make no money. When they’re out of stock or when they’ve priced it unreasonably, we do.

Between skyrocketing shipping costs and competition from Amazon.com, we’ve had to discontinue our beautiful Lauren the Lion on the right. Learn more here.

Problem #5: They can suspend you as they please and they make mistakes frequently. Over the years, Amazon has wrongly accused of us influencing customer behavior (banning us from e-mailing our customers on the platform), suppressed our products for being suspected of manipulating search results, accidentally deleted our account, and in April 2021 they threatened to suspend us for review manipulation. But this time, something strange happened. They admitted they got it wrong!

“Sorry” was previously not a word in Amazon’s vocabulary.

I sincerely have been pleasantly surprised by the strides Amazon has made in making their marketplace fairer for sellers. Whether it’s admitting that they’re wrong or making it harder for to manipulate reviews and search rank, these little changes are steps in the right direction. Keep it up Amazon! I still hate you, but slightly less every day.

Our Walmart.com sales in 2021 laid over our 2020 sales.

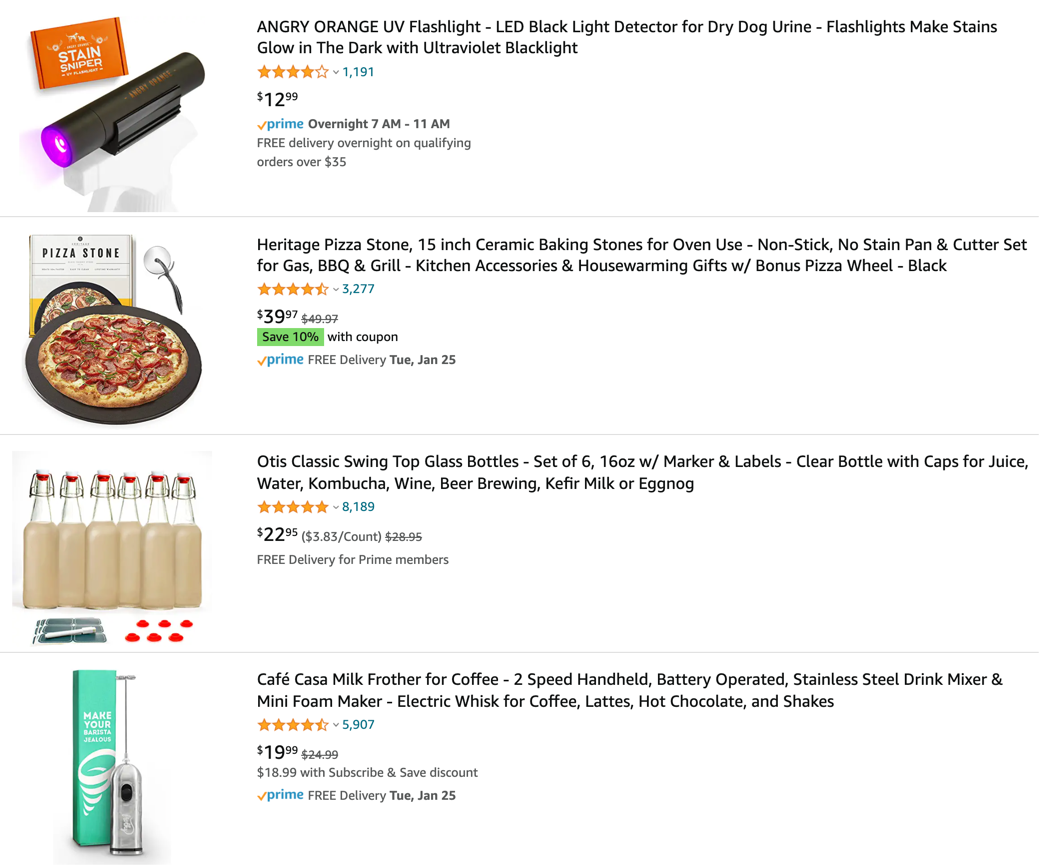

Walmart.com — 2.5% of Our Sales

Our sales grew 15.9% year over year on Amazon. On Walmart.com, they fell 22.7% on a significantly smaller base. Why? The answer is in the graph above. You see how 2021’s sales are above 2020’s from January through March? That’s post-pandemic 2021 vs. pre-pandemic 2020. You see how 2021’s sales are significantly lower than post-pandemic 2020? That’s Amazon shitting the bed. Prime was really screwed up in 2020 and it hurt their sales to the point of making customers willing to stoop to shopping on Walmart.com. Amazon had significantly fewer logistics issues in 2021 and customers came right back. Still a monopoly, baby!

What is WFS? It’s Walmart Fulfillment Services aka Walmart’s clone of Fulfillment by Amazon.

It’s hard for Walmart.com to compete with Amazon. Amazon has a huge fulfillment network that covers the United States and they’ve even added their own delivery service. Walmart is playing catch-up and is attempting to match Amazon’s success storing and shipping on behalf of sellers (Fulfillment by Amazon or FBA) with their own fulfillment program, WFS. When you convert a product shipping from your own warehouse to FBA on Amazon and win that coveted prime check, you can expect your sales to triple. When we tried WFS with Walmart our sales fell. When you store your inventory at WFS, Walmart tacks on a $5.99 shipping charge unless the customer is a Walmart+ member. Not enough customers are, so it effectively just raises the price for consumers, deterring sales. Walmart’s best shot at competing with Amazon is to use their strong grocery delivery offering to encourage more customers to sign up for Walmart+. If they figure out how to consolidate deliveries between groceries and products sold on Walmart.com, they have a chance.

WFS did not work for us and our sales fell 22% on Walmart.com, but it gets worse. Walmart seems to have changed their return and refund policies. It resulted in their 2020 1.9% refund rate rising to 5% in 2021. Further, in 2020, Walmart was restricting its marketplace from Chinese sellers. No longer. Even worse, Walmart rolled out an advertising platform like Amazon’s. Together, that is declining sales demand, rising supply (Chinese sellers), and additional costs from advertising and higher refund rates. We will not be dedicating our energy to this platform until I see meaningful progress towards them stopping the Amazon juggernaut 🤞.

eBay — 1.4% of Our Sales

It’s a dying platform in our category in all but used products. Amazon stopped allowing sellers of toys to participate in their new used program “renewed” so we shifted that volume to eBay. As a result, our sales rose 16% on the platform from $106,000 to $123,444. Maybe it’s not good for our brand to be selling our products at discounted prices, but I love giving our used and returned products another life (instead of sending them to a landfill). It’s also good for our shipping spend (helping us negotiate better discounts) and if we can offer joy and children’s education at even lower prices, that’s a win.

We launched a Shopify website for the first time in 2021 — BrainFlakes.com

Our direct-to-consumer website(s!) — 0.5% of Our Sales

Our direct-to-consumer website sales nearly doubled (from a paltry $23,000 to $42,000) but we had to launch a new Shopify website to do that. After considering the time and effort involved, these sales were hardly profitable. The reason why Amazon is so great and off-amazon direct-to-consumer is harder than it looks is customers. Amazon’s got them. Our new website didn’t. It’s a struggle to attract and then retain customers in a way that doesn’t burn a hole in your pocket via Facebook and Google ads.

A cool screenshot from our Japanese distributor’s Rakuten.co.jp store

International — 2.1% of Our Sales

Unlike most businesses our size, we have decided not to expand internationally on Amazon. Rather than deal with taxes, pricing, logistics, fulfillment etc. in these different regions, we focus on our home market, the United States, and developing newer and better products. We have chosen instead to develop a small but growing network of distributors in Japan, Canada, Australia, the UK, and the EU to sell our products in the countries they know best. We don’t make much money doing this, but we over tripled our international sales from $49k in 2020 to $180k in 2021. Thank you to the distributors who made that happen. Unfortunately, most of our distributor sales happen on Amazon’s foreign marketplaces, so it’s not true diversification from the world’s most powerful e-commerce company.

The Jungle Market in Doral, Florida representing our plush line!

Wholesale — 2.75% of Our Sales

Wholesale was by far the fastest growing segment of our business. Our wholesale sales in 2020 were $24,000. In 2021, they were $243,000 — that’s 10x growth. Every e-commerce company wants to diversify from Amazon. There are lot of different ways to do that and there is no right answer for how; it’s highly product dependent. A company selling supplements can spend big money on Facebook ads to acquire customers because, instead of a one-time plush animal purchase, they’re selling a subscription. For us, the best way to diversify our revenue away from Amazon has been through wholesale sales.

Our komodo, Kusumo, subbed in at the Kenneth C. Griffin Komodo Kingdom (yes, that Ken Griffin)

Covid was brutal to brick-and-mortar stores in 2020. By extension, the companies that focused on supplying those stores lacked much of the inventory needed when they did finally reopen. The San Diego Zoo opened a komodo dragon exhibit in 2021 but had no komodo dragons. Their old suppliers had no stock, but we did. Now we supply the most famous zoo in America with a whole mess of reptiles!

Amazingly, one the biggest wholesale deals we closed in 2021 actually came from a cease-and-desist. A large retailer knocked off one of our best sellers. We sent them a cease and desist and now they sell our products. Life is funny sometimes.

The growth is good, but it’s on such a small base. Add it all up and it’s less than our absolute sales increase on Amazon in 2021.

Acceptance of the Amazon Risk

Realistically, we’re stuck with Amazon. Yes, we tentupled our wholesale sales, but in absolute terms we added $219k. The 16% growth we got from Amazon was over $1.1 million. If we sold our best seller Brain Flakes to Walmart (the stores, not the marketplace), Amazon might play second fiddle, but would we be better off? We’d be stuck with a capricious buyer instead of a marketplace and what if our products hit the shelves and then didn’t sell? Bad news. Before reading this article had you heard of Brain Flakes? What is going to make you stop and buy something you’re not familiar with when walking down the Walmart aisle?

Brain Flakes at the North Carolina Museum of Art!

By necessity or practicality, sellers on Amazon come to terms with and accept the risk of Amazon being a dominant percentage of their business. Similarly, investors and bankers have too begun to accept this risk. Perhaps having 90%+ of your revenue at Amazon isn’t quite as risky as once thought, which brings us to our next topic…

The Rise of the Amazon Aggregators

Over $13 billion dollars have been raised to buy and combine (“roll-up”) companies that sell on Amazon. This has become a hot market, but it wasn’t always the case. In early 2019, the earnings multiples on companies like Viahart were 2-3x. I knew someone who sold for 3.5x earnings. That was unique; you could only do that if you had a really special company and brand. Then 2020 happened and with it a major spike in e-commerce sales. The Amazon aggregators who were buying up brands at 2-3x earnings with debt looked like geniuses, inspiring tons of competition from other amazon seller roll-ups.

Investors and bankers may not realize this, but the competitive outlook for the average Amazon marketplace seller has turned. Businesses like this one are no longer available for 2-3x earnings; 5-6x is much more common. Not a week goes by without our companygetting a phone call or an e-mail from one of these billion-dollar valuation roll-up companies professing their love for Viahart.

Some of the products offered by one of the largest aggregators. You see a random assortment, I see four totally different supply chains and no synergy.

Unfortunately, what makes sense at 2-3x earnings doesn’t at 5-6x because combining Amazon companies has weak returns to scale. Let’s say we bought another e-commerce toy company. We could combine our shipping spend with theirs and go to FedEx and UPS and renegotiate our rates. Maybe we could eliminate one warehouse and keep all our inventory in a single location. Unfortunately, when Amazon is doing your shipping and warehousing, these tactics don’t work; Amazon won’t negotiate on fees no matter how many companies you buy up; they’re too big.

These Amazon roll-ups are toast. They’re getting squeezed by Amazon’s rising costs on one side and vicious and unfair competition from China on the other. Further, the founders who sell are better and more motivated than the employees who take over. Combine all this with the debt they used to acquire these businesses, inflation, supply chain, and competition from Viahart 💪 and you have a problem!

This…is not normal. (Mario Tama / Getty Images)

Supply Chain Woes

First, what is a supply chain? It’s the sequence of goods, jobs, and transportation needed to make a physical product and then get it to consumers. If you’re making a shirt in Mexico, you’ve got to get the fabric from Los Angeles to Mexico and the buttons, thread, and tag from China. And then once it’s sewed up, you’ve got to either distribute it to stores across America or store it in Amazon’s warehouses all over the country so they can guarantee you that fast prime shipping you know and love. That’s the supply chain. It’s really messed up right now. Here are two examples of how that affected us in 2021:

1) Our supplier in Vietnam shut down for three straight months because of government imposed covid lockdowns. We had over $150k in inventory in two separate containers that we would have liked to sell at Christmas, just stuck in Vietnam for 3 straight months because of a failed lockdown attempt at controlling Covid. Both containers are on pace to arrive in 2022 and our current orders with that factory need 210 days to finish when previously it would have only taken 65 days.

Boat (red) from Jakarta to Singapore, then Kaohsiong in Taiwan, then to Seattle, and then to LA. Our container hopped on a truck to Texas (purple), but usually would’ve taken a train (black). The above lines and ports are representative and not the exact locations and paths.

2) We did our first ever production in Indonesia this year. When the goods were ready, perhaps because there weren’t enough containers at the port, a 40’ container with a dent at the top showed up at our factory. The dent caused us to only be able to fill the container 80% (making the cost of shipping for what we could fit 25% more expensive!). It waited at the port for multiple weeks while the boats that were supposed to come pick it up decided to skip the smaller port of Indonesia. This is despite us paying over $25,000 to ship it (a year earlier it would have been $4,000 or $5,000).

The boat it did get on was promised to arrive in Los Angeles around November 4th. Had our logistics manager not noticed that the boat was making detoured stop in Seattle, our container would’ve gotten been unloaded in Los Angeles after Christmas — not ideal for a toy company. We got our container unloaded in Seattle and then paid $7,500 to truck it to Texas. $32,500 total for a container that previously would have cost only $4k or $5k, never mind it taking significantly longer and being only 80% full. We got (ship)wrecked.

In 2020, it took an average of 107 days for us to get our goods. In 2021, 139 days.

In 2020, the average container-sized order took us 57 days to produce. Shipping it from Asia to Texas needed 49 days. In 2021, that same order took 64 and 75 days respectively. In other words, it’s taking over a month longer to get all our goods, even before we add in the additional time required to get our stock to Amazon’s warehouses and to customers. When it takes longer to get your goods, you need to hold more inventory for longer, which requires more money and just generally adds to cost. These additional costs are getting passed to consumers.

Inflation!

The other reason why Amazon aggregators and the e-commerce industry at large are struggling is inflation. Most direct to consumer businesses cannot raise prices without expecting their customers to switch to a cheaper alternative. So when the business’ costs rise, their profits shrink. Well, let me tell ya! Costs are-a-rising!

That outlier coming in at $37k is the Indonesia container I mentioned above (we split the shipment in Seattle which got the cost up to $37k).

The above is a graph of the cost we paid for moving a container from Asia to our warehouse in Texas. This cost has gone up 4 or 5 times and is showing no signs of falling. The extent to which this affects a given product is determined by the ratio of a product’s size to its production cost. The higher this ratio is, the more its price will rise for consumers.

Jani the Giraffe is very expensive to ship from Asia these days.

When you sell giant giraffes and tigers and compete against Melissa and Doug (a billion dollar toy company) and Amazon this poses a problem. Our costs for Jani the Giraffe have gone up considerably, but when we tried to price our items so that our profit margin remained constant after the cost increases, we failed; the increase was not accepted by customers. They bought Melissa and Doug’s giraffe instead. At the time of writing (January 2022), our giraffe is selling for $89.99, when, in order to make the same profit margin we were in 2019, we’d need to sell to be selling at $105.

An imperfect sampling of prices pre and post pandemic

But it’s not just containers that are skyrocketing in price. Everything is more expensive. Pallets were $3.75 in 2019, then $4.25 in 2020, and then in 2021 they were $10…and for a lower quality of pallet! As sellers on marketplaces, we pay a 15% commission to the marketplaces on which we sell. So if a shipping cost goes up by $10, we can’t just raise the price by $10, we need to raise the price $11.76 to cover the 15% commission so we are left with $10. This has a multiplying effect on costs for consumers. Further, when the cost of a $10 product rises to $20, we cannot just raise the price by $11.76. We must be compensated for the risk of carrying a $20 product in inventory instead of a $10 one. We must raise the price so that, after commissions, we have profits of $20, not $10.

Our Amazon sales 2021 vs. 2020.

I felt really good about our performance this year, until I saw this graph which gave me pause. Our best months in 2021 vs. 2020 were March, and June to November. What happened in March 2021? $1400 stimulus check. What happened in June 2021? Refundable $300/month/child tax credits (we sell toys!). What happen in December 2021? Those ran out at the same time as our sales fell (it also didn’t help that we almost no inventory from Vietnam owing to its 3 month covid lockdown). When you look at our sales this way, it’s almost like 2021’s entire sales increase was government stimulus driven.

Office isn’t dead — we use it for inventory storage! It has become so difficult to forecast inventory post-pandemic that we oscillate between an empty warehouse and this!

Getting “Dragged”

One of the largest price increases we’ve seen has been in the cost of the temporary labor we use to help unload containers. In 2019, we were paying $10/hour. On our last unload in January 2022, it was $15.50/hour. That’s a huge difference. On October 12th, 2021 I casually typed a tweet about this phenomenon and then I proceeded to have a very interesting experience…

The tweet went viral. It appeared multiple times on reddit and even made it into an opinion column of the New York Times (to which I replied in a letter to the editor). Brain Flakes, a suspected cereal for zombies, was a trending term on Twitter, bringing tremendous attention to our company and brands. Unfortunately, my carelessly typed tweet, which was about inflation, was being misinterpreted as a complaint about work ethic. People, many of whom living in cities where the cost of living is significantly higher than in the area where we have our warehouse, thought I was surprised that people wouldn’t work for $14/hour. I was surprised, but I was surprised in the context of us being able to attract people at $10/hour pre-pandemic.

With this misinterpretation came an angry mob, which crescendoed with one person, threatening to kill me and then publishing my home address on Twitter. I was traveling at the time and I’ll never forget getting a Facetime call from my wife who was back at home. She was frantic on the screen, holding my handgun, asking me how to use it. It was terrible.

Fortunately, no one showed up at our house, but the headaches didn’t stop there. People left negative reviews on our products on Amazon and sent insulting messages to our customer service. Looking into the eyes of my employees and family knowing that I had created this mess was difficult. Our sales went up that day actually, but it was a harrowing experience. What doesn’t kill you makes you stronger and I’m thankful my team stuck by me throughout the episode.

Tying up 2021

I made a lot of mistakes in 2021. I waited too long to order inventory from our factory in Vietnam when the writing was on the wall that covid would be disruptive, I made a bunch of bad hires, and I even sent $43,750 to a fraudster in China. Despite all that, I feel pretty lucky that our sales rose when many fellow Amazon sellers’ sales fell. We owe that success to the hard work and execution of our team.

Our customer service team made the 10x increase in wholesale sales happen.

Our logistics team worked with dozens of brokers all year to keep our shipping costs down.

Our production team’s attention to quality and our design team’s continuous product improvement and innovation were what enabled us to survive vicious competition.

Our warehouse team’s efficiency improvements kept our prices low for consumers despite facing rising costs. And their team of two unloaded 35,000 pounds of Brain Flakes when no temporary labor showed up 💪!

I’m proud of what our company accomplished in 2021, but nothing was better than this new product release — we had a kid!

Whitaker the wolf, Winry the wolf, a Brain Flakes rainbow, and baby Zealand

What does 2022 have in store?

It’s going to be a really tough year for most companies in e-commerce, especially those who have debt that isn’t fixed rate. Inflation is going to keep coming and it’s going to squeeze profit margins. Derisk your business, cut unprofitable skus, and get ready for a wild ride. 2022 is already shaping up to be the most difficult year in our company’s existence.

Amazon said their 2022 fees were rising 5.2% — they went up 45% for us.

Just as I was finishing writing this article, the above Amazon fee increases hit. Ouch. With these cost increases, for most products, Amazon is significantly more expensive to ship from than our own warehouse. However, we can’t lower our prices off-Amazon to compensate for that. If we do, our products will be suppressed by Amazon.

2021 was crazy and there ominous clouds on the horizon for 2022, but between our growing and ever-improving team, our plans for 2022, and the new warehouse we are building in Austin, I am very optimistic for our company! If you enjoyed reading this article, you may want to:

Follow me on Twitter where I write about more than just e-commerce

Check out our STEM building toy Brain Flakes (hell yes these are SEO links)

Subscribe to my newsletter below

And if you live outside the USA and would be interested in distributing Brain Flakes in your country, get in touch!